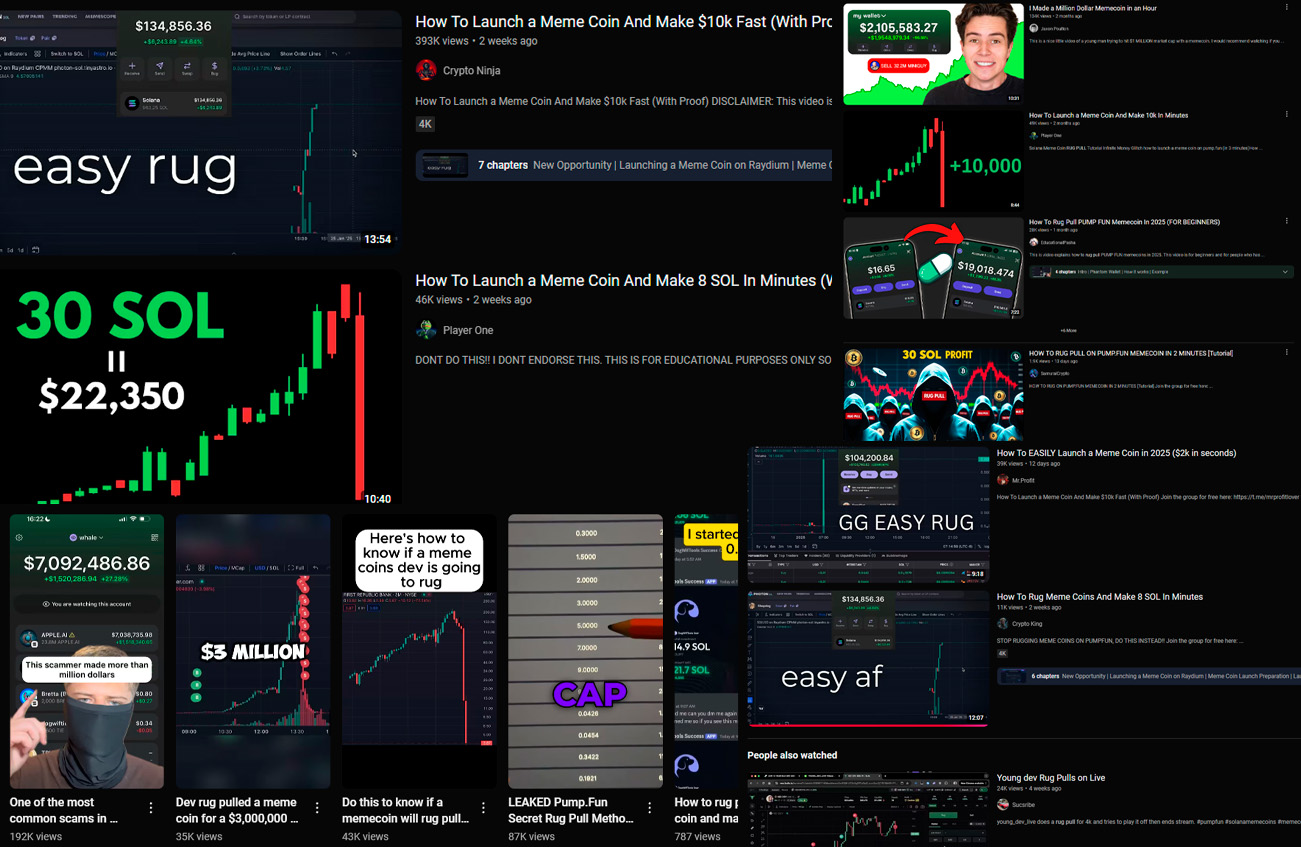

Welcome to the golden age of degens, where launching a token on Solana is easier than ordering a McDonald’s cheeseburger at 2 AM while three beers deep. And boy, do people love their cheeseburgers. Right now, we’re in the middle of an unprecedented, absurd, and yet completely real boom of token launch platforms that let anyone with two brain cells (and often less) create their very own shitcoin in mere seconds. The results? A festival of instant rugs, zero-utility memecoins, and liquidity pulled out by the creator faster than your ex gets tired of Gigachad´s massive dong.

Back in the olden days, launching a token required effort. There was some coding, maybe a whitepaper, and at least a pretend roadmap before someone hit the deploy button. Now? Enter platforms like Pump.fun/Moonshot, VVAIFU, Coinfast, Smithii, etc, and a dozen other launchpads that exist purely to enable the next big rug. These services let literally anyone spin up a token with a few clicks. You don’t need a dev. You don’t need a plan. You don’t even need common sense.

Some platforms allow liquidity draining through third-party services. You know, so it looks legit—until the owner finds a backdoor and poof, there goes your 17 SOL investment straight into his Trezor. Absolute degeneracy at its finest.

One of the most absurd yet disturbingly real trends in Solana token launches is the liquidity draining scheme. Imagine this: a random individual decides to launch $REALBAG on a sketchy launchpad. It looks bullish, right? Сlear tokenomics – what could possibly go wrong?

Here’s where the trick comes in: traders often don’t realize how quickly liquidity can be drained. Platforms like DexScreener may not immediately reflect the underlying issues. The average trader checks the chart, glances at the volume, and perhaps gets swept up in a Telegram group filled with hype, all before jumping in. Meanwhile, that seemingly safe supply is just a ticking time bomb, poised to explode when the developers decide to make their move.

Through untraceable mint functions, sneaky tax mechanisms, or clever contract backdoors, the devs have already manipulated the system. One moment, the token appears to be skyrocketing; the next, your portfolio has crumbled into dust.

And just like that, the developers vanish into thin air. The liquidity is drained, and your dreams plummet alongside the chart. Your SOL is gone, and you’re left holding an overwhelming stack of 17 trillion $REALBAG tokens, worth little more than negative respect.

In the chaotic world of crypto, developers are bundling wallets like it’s a twisted game. Picture this: unsuspecting hamsters tossed into the fray, caught in a whirlwind of liquidity pools and wild token promises. While the devs chuckle in the shadows, these little creatures spin on their wheels, navigating a maze of smart contracts. It’s a degen playground where only the sharpest survive. So, keep your eyes open—because in this game, one wrong move could send you spiraling into the void.

The short answer? Because they can. The long answer? Because degens are addicted to gambling in ways that make Vegas look like a preschool playpen. Token launch platforms are just casinos for the hopelessly addicted. Everyone thinks they’re the next $WIF or $BONK millionaire, but statistically speaking, you’re way more likely to be the guy who buys the top and gets left holding the bag while the devs fly to Dubai.

One of the biggest mysteries in this whole circus is why popular charting platforms don’t show scam indicators like above? You’d think DexScreener would give you a simple ‘Liquidity Locked/Drained: Y/N’ column. But nope. Instead, degens are left guessing, relying on Twitter call-outs, sketchy Telegram insiders, or just pure vibes.

Some platforms have ‘scam indicators,’ but they’re about as useful as a magic 8-ball with only one response: “Reply hazy, try again.” Even when they do flash a warning, most people ignore it because—let’s be real—degens are gonna degen.

Why don’t these platforms take stronger action? Well, that would mean less volume, less engagement, and less revenue for them. As long as people keep aping, keep trading, and keep getting rugged, everyone upstream keeps making money. The only people who lose are, well… you.

The cycle continues. New launchpads pop up. More degenerates ape in. More rugs get pulled. Liquidity drains like a financial horror movie on loop. And through it all, we sit here, watching, laughing, and occasionally getting rugged ourselves because, deep down, we all love the madness.

Because in the end, Solana’s token ecosystem isn’t about making money. It’s about the experience.

And what an experience it is.