In the crypto industry, two things are certain:

These people are the guardians of an ancient FUD (Fear, Uncertainty, and Doubt) tradition. The second BTC paints a red candle, they crawl out of their caves with the confidence of a time traveler who has just returned from the future. “Alt season is dead,” they declare when ETH drops 3%. “The market is finished,” they proclaim at every dip, as if they haven’t seen this scenario play out a thousand times before.

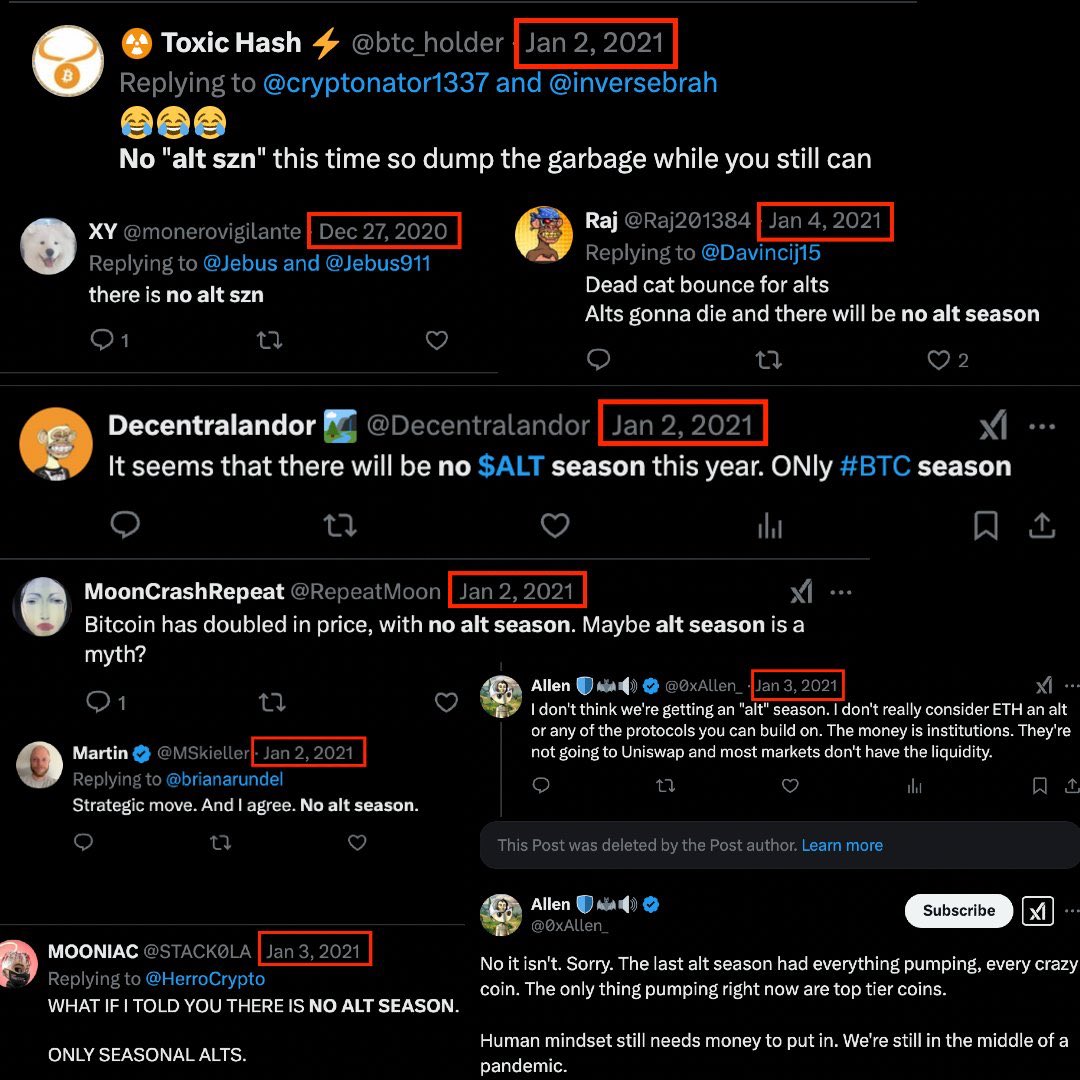

A quick scroll through Twitter (or X, for those who insist) will reveal a goldmine of bad takes. In 2020, right before the biggest bull run in history, they screamed, “There will be no alt season!” In 2021, as ETH soared to $4,000, they declared, “It’s over!” In 2023, they chanted, “Bear market forever!” Every new generation of FUD-oracles follows the same script, but history, it seems, is not their strong suit.

And if you think it’s bad in the main crypto markets, welcome to the meme coin sector, where reality doesn’t even exist, and logic was sacrificed in a liquidity pool long ago. Here, every 10% correction is treated like the apocalypse. Telegram chats turn into crisis hotlines, influencers switch from “We’re all gonna make it” to “Exit while you can” in 30 seconds, and some absolute degens start eulogizing the entire market because one $PEPE whale market-sold his stack. The chaos is chef’s kiss perfection.

There are a few possible explanations:

“The cycle is over!” has become a meme because it gets repeated every single time the market moves. Sure, one day, one of these doomers will be right—but if you predict the end of the world every week, eventually you’ll hit the jackpot. So next time you see a dramatic “It’s over!” post, just smile, zoom out, and watch the same old movie play out again.

Oh, and when the next bull run starts? Watch them delete their tweets faster than you can say “new ATH.”

Meanwhile, in meme coin land, nothing will change. Some degen will still market buy a random token because he liked the logo, and someone else will proclaim that a JPEG is definitely the next $DOGE. The game never ends. Only the players change.